Find your perfect home

I make the homebuying process as simple as possible. As a local real estate expert, I use my industry contacts and leading technology to find your perfect place and negotiate the best possible price for your home. Whether you’ve done this before or it’s your first time, I’ll guide you every step of the way.

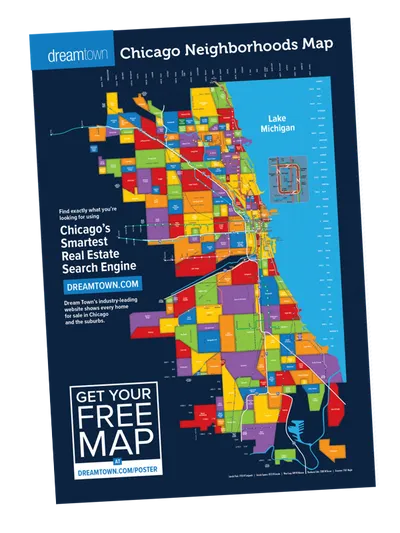

Claim your FREE neighborhood map!

Searching for the perfect neighborhood? My Chicago neighborhood map is the perfect guide!

Testimonials

-

Diana was extraordinarily helpful in our house hunt. She identified our dream house the day it came on the market. She then helped us negotiate…

-

Diana is a wonderful and charming person, and a great Realtor. For first time buyers she was easy to work with, always available (day, night,…

-

I cannot say enough good things about my experience with Diana. I was a first time home-buyer with really no idea about what I was…

-

As first time home buyers, we weren’t too sure what we were getting ourselves into. From our first conversation with Diana, we knew we were…

-

We first connected with Diana randomly through the Dream Town web chat, and it was quite a fortunate find for us! She was the most…

-

We met Diana through our son, and can’t say enough wonderful things about her. We had very specific parameters — location, price, age, etc. —…